Most "high-growth fintech" stories collapse when you dig into the numbers.

NU Holdings (NYSE: NU) is different:

39% net margins (8x industry average)

28% ROE (2x Brazilian banks)

$10.6B net cash (fortress balance sheet)

123 million customers (network effects + data moat)

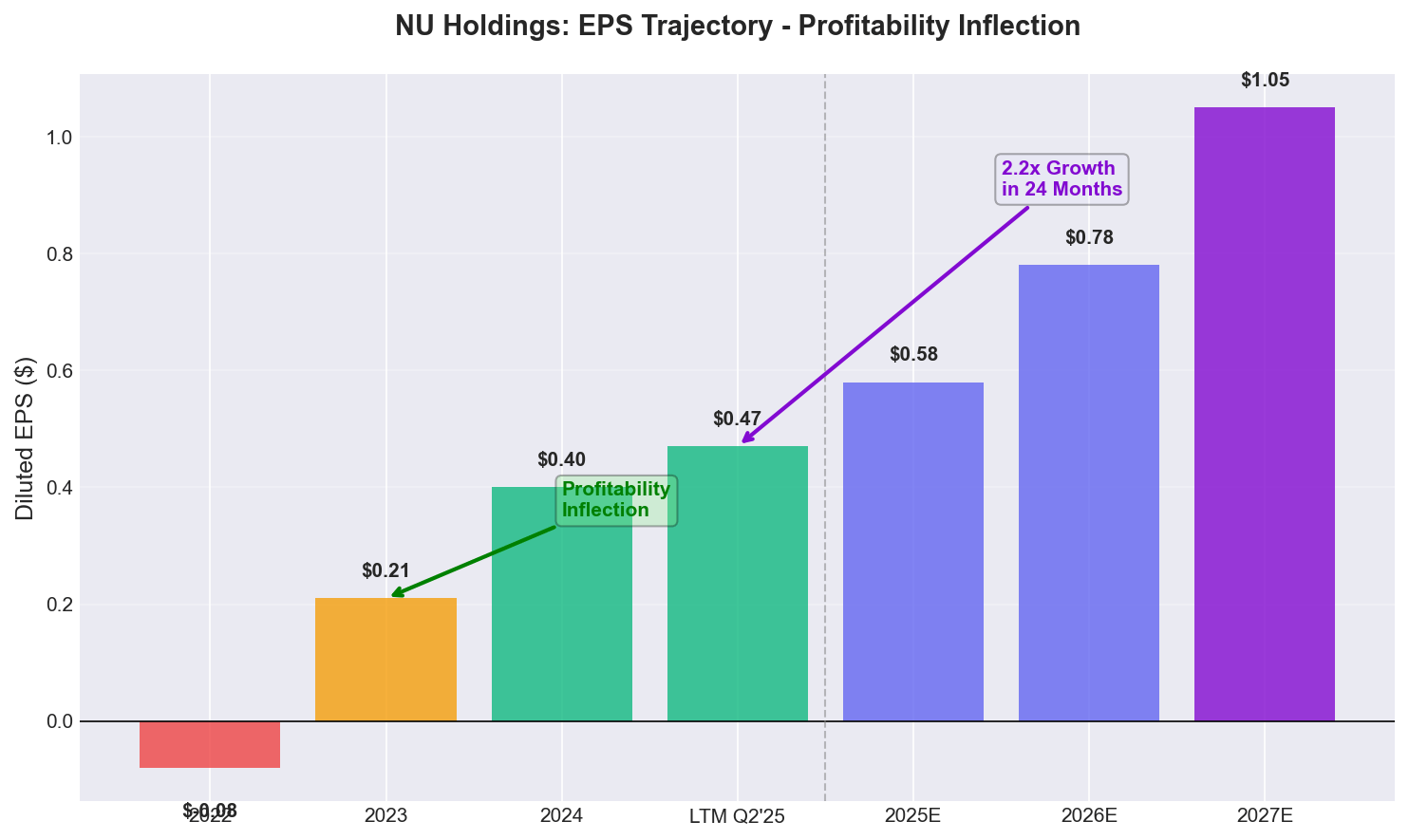

This isn't a speculative bet on future profitability. NU is already profitable, already scaled—and now accelerating.

Why Now? Three Catalysts Converging

NU's growth is re-accelerating after quarters of deceleration. Transaction Margin Dollar (TM$) growth hit +8%—the fastest pace in 8 quarters.

The strategic initiatives management has been investing in are now delivering measurable results.

And the market still hasn't priced this in.

Three Catalysts Already Proven (Not "Coming Soon")

1. Mexico Profitability Inflection

8.9M customers, 28% market share of credit card growth. Management has a clear roadmap to profitability by Q4'26.

The report details: quarterly milestones, ARPAC trajectory, unit economics breakdown, and TAM analysis.

2. Hyperplane AI Deployment

Early results in Brazil showed immediate market share gains. Now rolling out to Mexico and additional products through 2027.

The report details: technical architecture, deployment timeline, ARPAC acceleration model, and risk factors.

3. INSS Secured Loan Recovery

Government-backed loans growing 200% YoY with zero credit risk and high margins. This is NU's fastest-growing product.

The report details: portfolio composition, margin impact, regulatory framework, and growth sustainability.

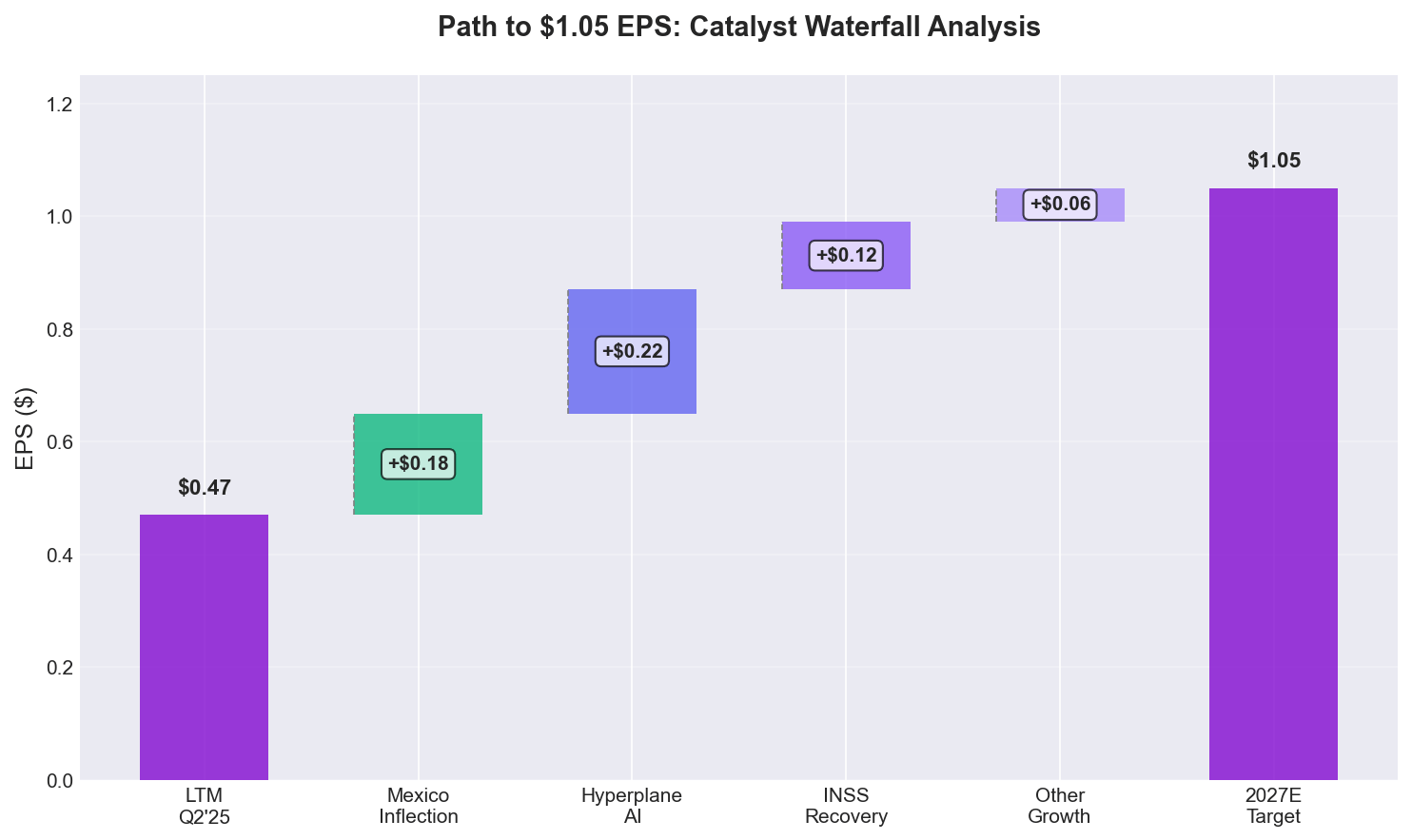

The Math That Works

Our $22 base case target (+46% upside) assumes:

Moderate execution on Mexico profitability

AI deployment continues at current pace

INSS recovery sustains 150%+ growth

The full report includes:

Three scenario analysis (bear, base, bull) with probability weightings

Sensitivity tables for P/E multiples and EPS assumptions

DCF valuation, sum-of-the-parts, and peer multiple triangulation

Detailed risk/reward breakdown showing 1:6 asymmetric upside

Get the complete valuation methodology in the full report below.

Why the Market Is Wrong

NU trades at 32x P/E despite:

28% EPS growth (vs S&P 500 ~10%)

30% ROE (2x Brazilian banks)

15-25x cost advantage vs traditional banks

The market is pricing in "share loss to incumbents."

But Q2'25 data proved the opposite: NU is gaining market share and accelerating growth.

Inside the Full Report (21 Pages)

I spent 20+ hours analyzing:

10-Q/10-K SEC filings (2022-2025)

Q2'25 earnings call (line-by-line)

Competitor benchmarking (V/MA/XP/INTER)

Brazil/Mexico macro data

Management track record (11/12 quarters of guidance beats)

What you get:

✅ Complete Financial Model (2025-2027E projections)

✅ Five Professional Charts (300 DPI, presentation-ready)

✅ Catalyst Deep Dives (Mexico TAM, AI technical breakdown, INSS recovery)

✅ Risk Assessment (Brazil recession, FX, competition, regulatory)

✅ Entry/Exit Strategy (position sizing, quarterly milestones, red flags)

This is Investment Committee-grade research.

The same analysis institutional investors pay $2,000+ for from sell-side banks.

You're getting it for free.