Dear Subscribers,

Welcome to the first annual review of the TomALPHA strategy. Transparency is the only metric that matters in this industry.

In 2025, the market was defined by noise—inflation prints, geopolitical tensions, and rate cut speculation. While the crowd chased headlines, we focused on valuations and cash flow. The results speak for themselves. We didn't just beat the index; we outperformed it by a factor of five.

This document serves two purposes: to verify our track record with absolute transparency and to outline the specific, high-conviction opportunities we are targeting for 2026.

No courses. No Discord. Just math.

1. Performance Verification

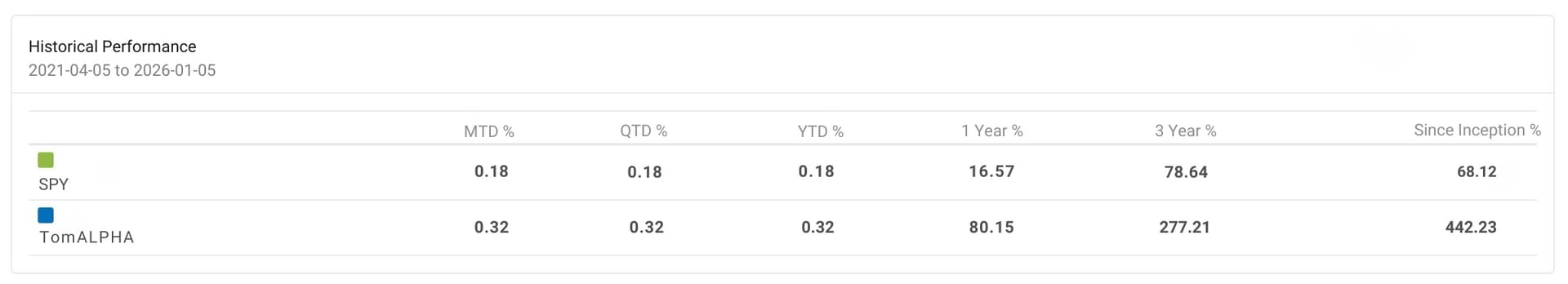

Numbers don't lie. Here is the final reckoning as of January 5, 2026.

Timeframe | TomALPHA Strategy | S&P 500 (SPY) | Alpha (Spread) |

|---|---|---|---|

2025 (1-Year) | +80.15% | +16.57% | +63.58% |

Since Inception (Apr 2021) | +442.23% | +68.12% | +374.11% |

Note: Performance is net of fees, based on real executed P&L (Interactive Brokers).

2. Current Portfolio Positioning

We enter 2026 with a portfolio that is fully invested (100% Long Equity) with a tactical hedge. We are betting on undervalued sectors with high free cash flow that have been ignored by the passive indices.

🌍 Regional Allocation

We are overweight Emerging Markets and Europe vs. US Tech.

🇺🇸 USA / Global: 45% (Focus on Fintech & Software)

🇪🇺 Europe: 35% (Focus on Consumer & Travel Recovery)

🇨🇳 China: 15% (Deep Value / Tech Regulatory Pivot)

🇰🇿 Other EM: 5% (Kazakhstan Fintech)

🏗️ Sector Allocation

💳 Fintech: ~36% (PYPL, EEFT, NU, KSPI)

🛍️ Consumer/Travel: ~32% (WIZZ, ZAL, TUI, EVO, BOSS)

💻 Tech/Software: ~18% (WIX, NICE, S)

🐼 China Tech: ~14% (BABA, JD, BYD)

💼 Full Holdings Breakdown

Ticker | Sector | Current Price | Target Price | Upside |

|---|---|---|---|---|

$EEFT | Fintech | $74.10 | $165.0 | +123% |

$PYPL | Fintech | $58.14 | $100.0 | +72% |

$KSPI | Fintech | $77.54 | $133.0 | +72% |

$NU | Fintech | $17.02 | $24.0 | +41% |

$S | Software | $14.64 | $28.0 | +91% |

$NICE | Software | $111.94 | $195.0 | +74% |

$WIX | Software | $100.97 | $170.0 | +68% |

$EVO | Gaming | 17.80 | 995* | +61% |

$TUI | Travel | €8.89 | €13.0 | +46% |

$WIZZ | Travel | £13.03 | £18.9 | +45% |

$ZAL | Retail | €23.89 | €34.0 | +42% |

$BOSS | Retail | €35.51 | €48.0 | +35% |

$BYDDY | China | $95.80 | $165.0 | +72% |

$JD | China | $29.53 | $46.0 | +56% |

$BABA | China | $157.86 | $215.0 | +36% |

🛡️ Hedge: We hold 3x Long Put options on SPY as insurance against short-term volatility.

3. The Watchlist: High-Conviction Setups

Patience is our greatest edge. Below is the list of companies I am tracking. I buy ONLY if the price drops into my "Buy Zone".

💡 Current Opportunity: $MELI is currently trading in the buy zone.

Ticker | Current | 🎯 Buy Zone | Target | Upside | Status |

|---|---|---|---|---|---|

$MELI | $1,973 | <$2,000 | $2,810 | +42% | 🟢 BUY NOW |

$GRAB | $5.08 | $5.08 | $6.55 | +29% | 🚧 WATCH |

$META | $650.41 | $600.0 | $800.0 | +23% | WAIT |

$ADBE | $333.3 | $299.0 | $505.0 | +51% | WAIT |

$UNH | $336.4 | $300.0 | $370.0 | +10% | WAIT |

$DELL | $127.8 | $120.0 | $176.0 | +37% | WAIT |

$NVO | $52.39 | $40.0 | $79.0 | +50% | WAIT |

*Buy Zone represents the level with maximum Risk/Reward ratio. Target is based on DCF models for 2027.

Outlook & Final Thoughts

Looking ahead, I expect the divergence between "the market" (indices) and individual stocks to widen. The easy beta returns of the last decade are behind us. 2026 will be a stock-picker's year.

Our strategy remains unchanged: We hold our winners, we hedge our tail risk, and we wait patiently for our "Buy Zones" to be hit. When they do, we strike aggressively.

Thank you for being part of the journey.

- TomALPHA

Disclaimer: This is not financial advice. I am sharing my personal portfolio and research. Invest at your own risk. Past performance is not indicative of future results.

© 2026 TomALPHA Trades