Wall Street is staring at the wrong line items. While analysts panic over B2C gross margin compression, they are missing the silent explosion in B2B profitability. This isn't a turnaround story; it's a business model evolution. We are witnessing the birth of the European Logistics Grid, priced like a dying department store.

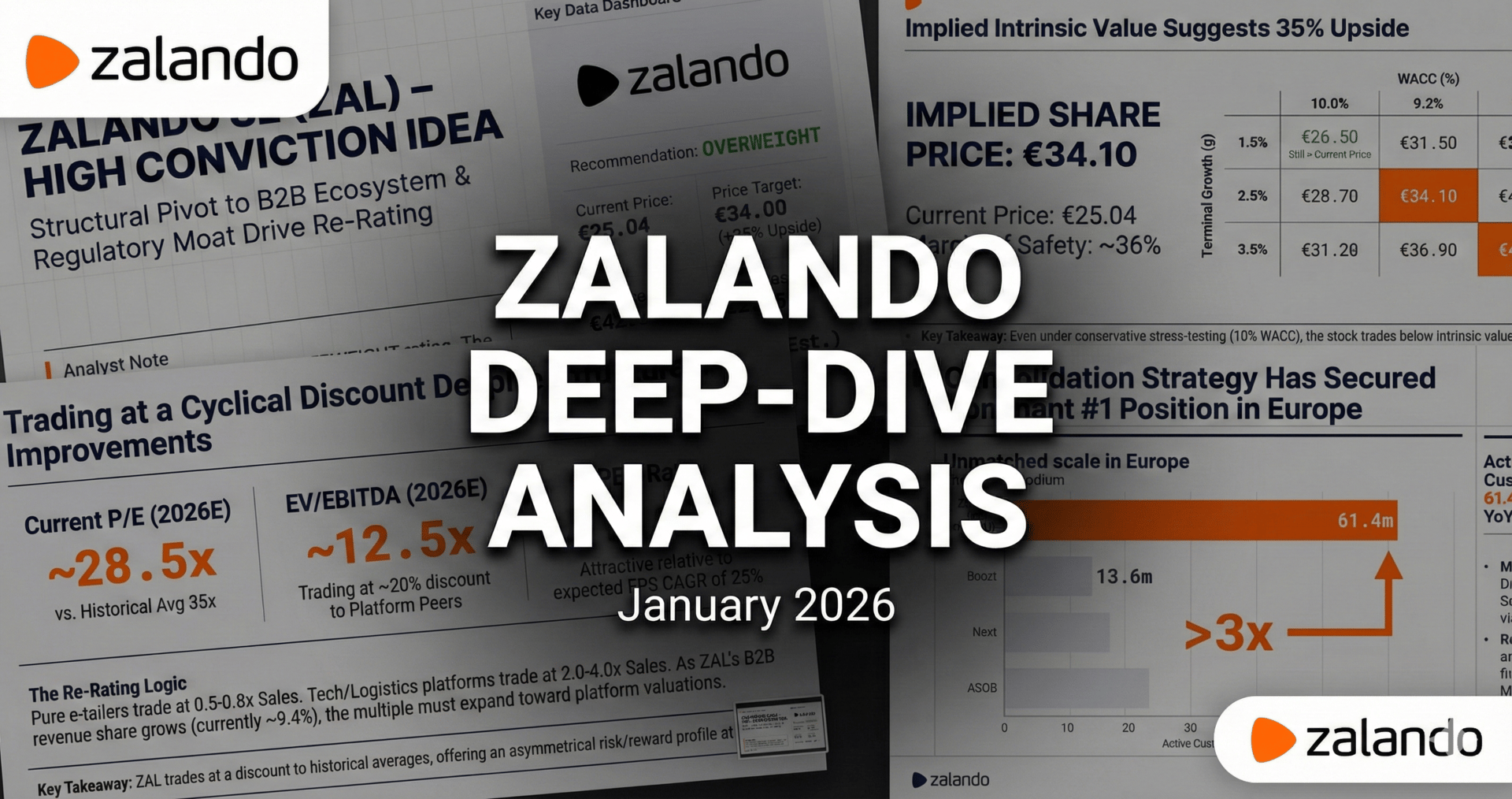

The Mispricing: Consensus values ZAL as a legacy retailer (0.5x Sales) fighting a losing war. We value it as a nascent logistics utility (ZEOS/SCAYLE) trading at distress levels.

The Hard Data (Q3 2025): While B2C margins compressed, B2B margins exploded +190bps YoY to 4.7% on 13.2% revenue growth. The pivot from "selling clothes" to "selling infrastructure" is executing faster than modeled.

The Moat: With 61.4M consolidated users and the impending EU customs reform (mid-2026) removing the de minimis threshold, ZAL has built a fortress against Asian fast-fashion that cannot be replicated.

The Alpha: Peers trade at >20x EV/EBITDA. ZAL trades at ~12.5x. We are buying the re-rating.

Full valuation model, regulatory timeline, and the "Hidden Asset" breakdown are inside.